Chief Investigators

Prof. Prasad Kaparaju (Griffith University)

Purpose of project

This Opportunity Assessment produced a research roadmap to identify the most impactful activities that RACE for 2030 could fund under the B5 research theme over the coming years. The research roadmap was developed through deep partner engagement, including through an Industry Reference Group that was established for this opportunity assessment.

Findings

- Although there were over 200 anaerobic digestion (AD) facilities in operation, there was not a commercial biogas upgrading plant in operation – the first is the Jemena Malabar Biomethane Project, which was scheduled to start grid injection in Q2 2023 – and 40% of AD facilities were only flaring their biogas, not using it. Landfill and wastewater accounted for over 70% of the facilities.

- Behind-the-meter operations are well established and may currently be financially viable if high energy biomass and thermal demand coexist, although it has a limited market scale and scalability.

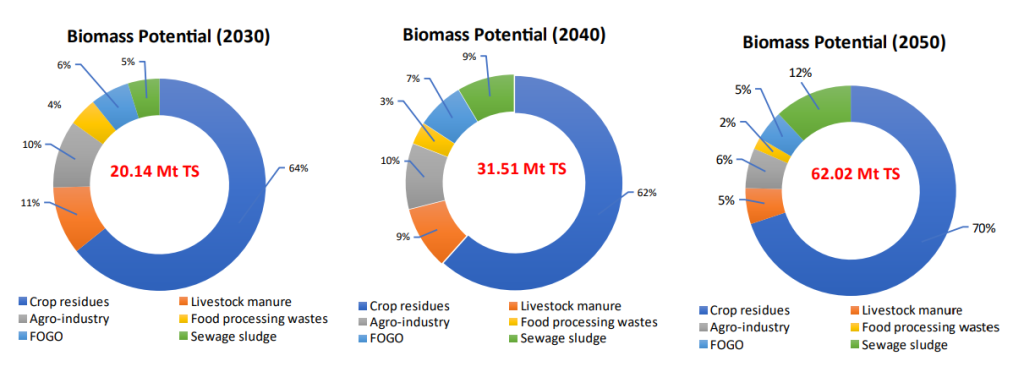

- Approximately 62 million tonnes of dry matter (biomass) feedstock is available for biogas production, mostly (~70%) from agricultural crop residues (Refer to Figure 1). The cheapest biogas feedstocks, such as sewage waste, livestock manure and food and garden organics (FOGO), can provide 14% of the biogas potential.

- The AD market size could be increased by gas pipeline network injection, which is an alternative to compressed natural gas and power to gas for energy storage, as has occurred in Europe, North American and other countries.

- There are significant barriers to AD adoption which include social (public perception), technical (infrastructure, feedstock supply, gas and digestate characteristics), economic (knowledge, uncertainty, risks) and regulatory (missing, inadequate or complex regulations) issues. Comprehensive details are available in the report.

Figure 1: Estimated total biomass (feedstock) potential in Australia, 2030 to 2050

Potential impact

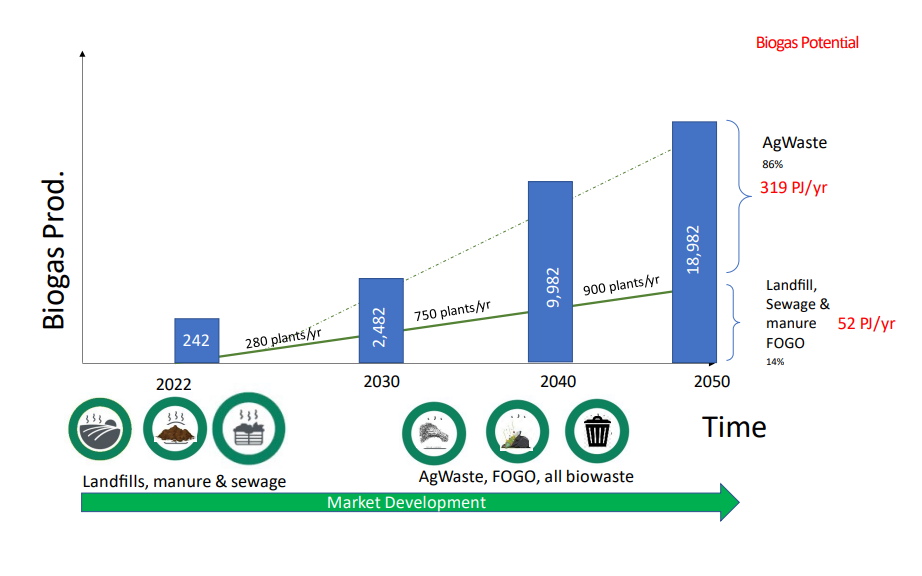

This research theme identified a total biogas potential is 371 PJ/year in 2050, which is 23% of current fossil methane consumption and more than 50% in 2050 once fuel switching away from fossil methane has occurred, as indicated in the figure below. Adoption of biogas technology could provide over 18,000 full-time jobs, mostly in regional areas, and contribute $50 billion to Australia’s GDP.

The biogas industry could help avoid the release of 13 Mt CO2-e annually by 2050 by replacing fossil fuels such as natural gas.

Figure 2 – Biogas potential in Australia, 2022 to 2050

To completely phase out fossil gas in the gas pipeline network, the remaining balance of energy must be provided by green hydrogen and synthetic methane, which is produced from hydrogen and carbon dioxide. Full details are available in the report.

Research roadmap – the path to decarbonisation

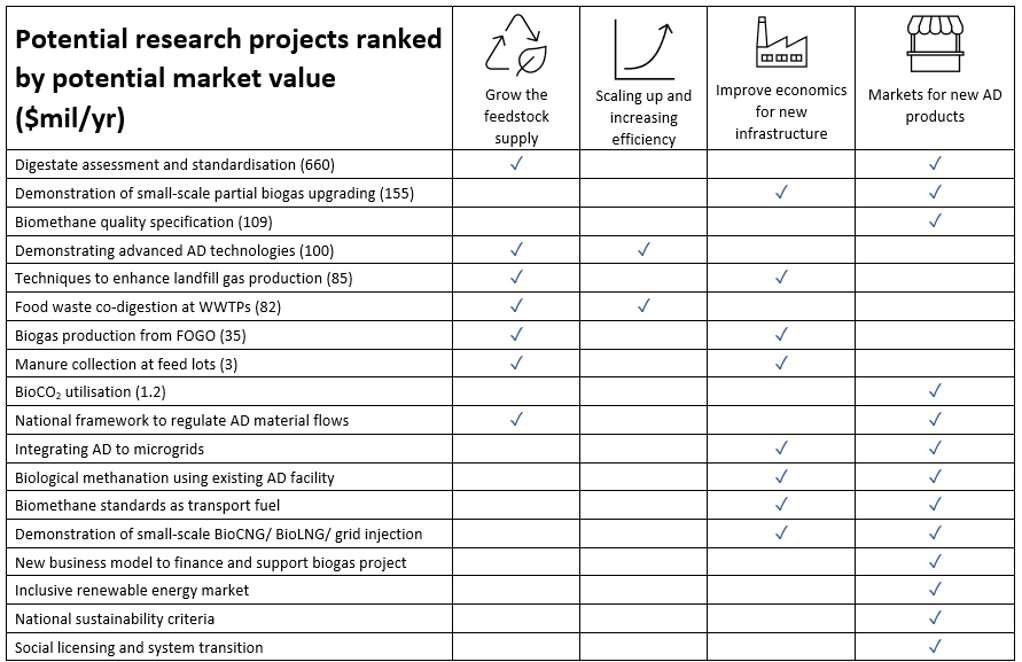

Potential research projects are shown in Figure 3 below, and cover the main themes of feedstock development, economics (scaling up and increasing efficiency, and improving economics for new infrastructure) and market development for new AD products.

Figure 3: Research roadmap for biogas in Australia

Project partners – industry and research

Griffith University (Lead), Australian Alliance for Energy Productivity (A2EP), Australian Meat Processor Corporation (AMPC), Climate-KIC Australia, DEECA (VIC), NSW DCCEEW, Queensland Farmers Federation, Singh Farming, Sydney Water, UTS

Industry Reference Group members

AGL, APA Group, Australian Renewable Energy Agency (ARENA), Bioenergy Australia, Clean Energy Finance Corporation (CEFC), Clean Cowra, Clean Energy Regulator, Corporate Carbon, EDL, ENEA, Gaia Envirotech, Helmont Energy Pty Ltd, Jemena, Queensland Farmers Federation, Singh Farming, Sydney Water, Veolia

Published Report

Status

- Completed

Opportunity Assessment

- Completed

Project Leaders

- Prasad Kaparaju, Griffith University

Completion Date

May 2023

Project Code

0187