Chief Investigators

Jay Rutovitz (UTS)

Purpose of project

This report delves into the projected electricity workforce requirements stemming from the Australian Energy Market Operator’s (AEMO) 2024 Integrated System Plan (ISP). These projections encompass technology, location and occupation, focusing on electricity generation and storage as well as the construction of new transmission lines outlined in the ISP.

The primary goal of this report is to equip stakeholders with a comprehensive understanding of the workforce implications associated with various electricity scenarios explored in the ISP. By doing so, it empowers state governments, the electricity sector and education providers to develop informed and responsive polices, plans and programs.

The foundation of these workforce projections was laid out in 2022 under a RACE for 2030 project co-funded by some Australian state governments. This earlier work recommended that AEMO consult with ISP stakeholders on integrating employment profiles into the ISP. Stakeholder feedback supported the ISP’s role in highlighting workforce needs, leading to high-level commentary on workforce requirements and projections included in the 2024 ISP. This current report, commissioned by AEMO serves as a Supporting Document in the 2024 ISP.

Findings

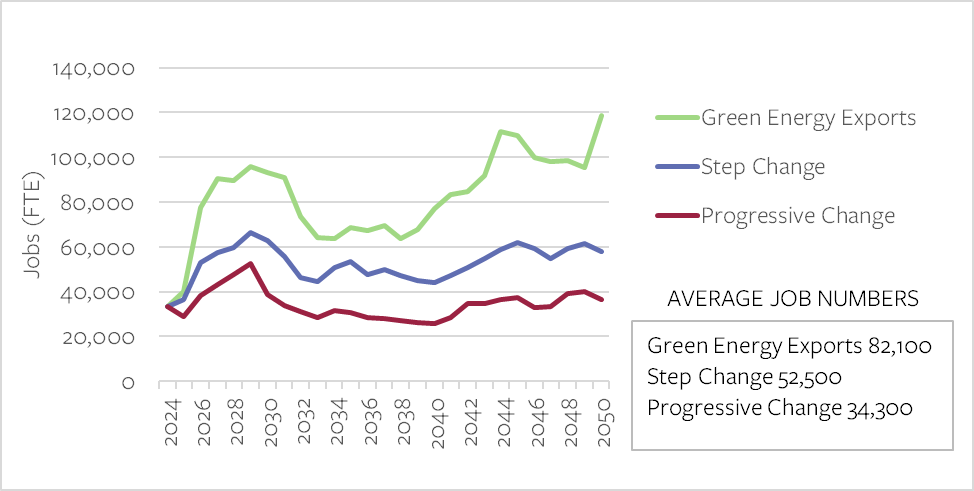

- A rapid scale up of the energy workforce is needed to implement the optimal development path in the Integrated System Plan (ISP) for all three of its scenarios. Under the Step Change scenario – considered most likely by energy stakeholders and well-aligned with policy commitments by Federal and State Governments – overall electricity sector employment will have to double to 66,300 by 2029. If Australia becomes a major exporter of renewable energy (the Green Energy Exports scenario), almost 63,000 additional electricity sector workers would be needed by 2029, rising to almost 119,000 total workers by 2050.

Figure 1 National Electricity Market total job numbers by scenario

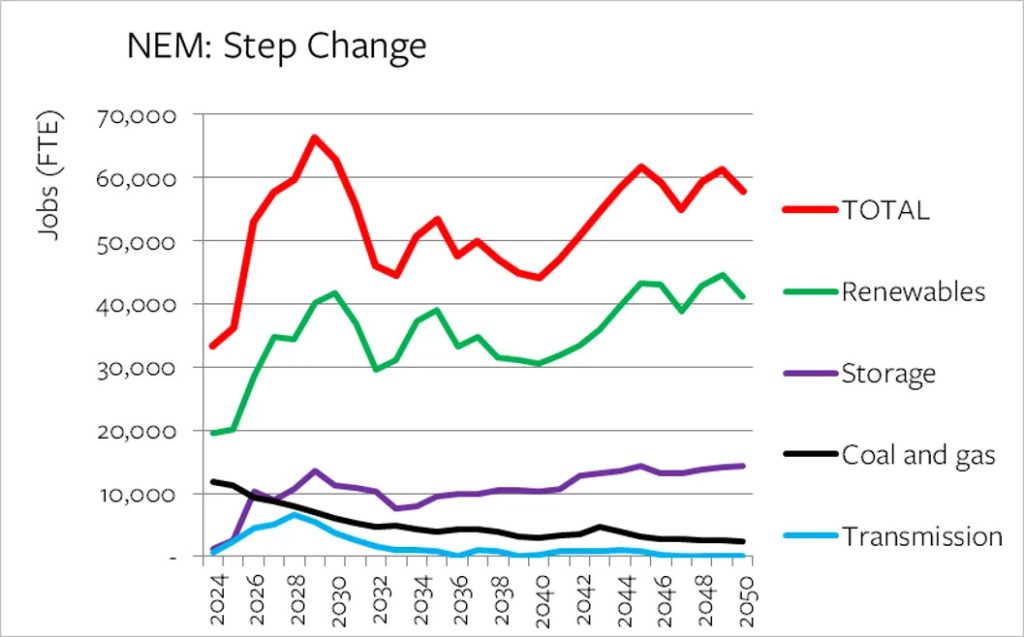

• Under all scenarios, most employment growth occurs in wind farms, solar farms and distributed batteries, while rooftop solar jobs are constant. In terms of workforce decline, while coal and gas together initially make up 35% of the electricity sector workforce, this drops to 6% in Progressive Change (a scenario with a constrained economy), 4% in Step Change, and 2% in Green Energy Exports by 2050. Jobs in coal reach zero in Step Change by 2038, and in 2034 in Green Energy Exports. In Progressive Change, 800 jobs remain in 2050.

This decline is outstripped by the increase in other electricity sector jobs, offering some opportunities for transition employment. However, these jobs may not be in similar occupations or locations, and additional planning and diversification is needed to ensure a smooth and just transition for coal regions and communities.

• Under all scenarios, construction dominates the employment profile through the 2020s as the build-out of renewable energy, transmission and storage accelerates, with the majority of jobs being in operations and maintenance from 2033 onwards. Construction employment in large scale technologies is subject to major upswings and downswings, with increases of 27,000 in just five years to 2029 in Step Change (16,000 in Progressive Change and 50,000 in Green Energy Exports), followed by sharp drop offs: the Step Change peak is followed by losing 24,000 construction jobs over four years, and the Green Energy Exports scenario adds 50,000 and then loses 38,000 construction jobs in the same period. This ‘boom/bust’ pattern creates significant risks for labour supply, exacerbated by competing demands for infrastructure build in other parts of the economy and the fact that much of the energy infrastructure is in rural areas.

• Those occupations primarily needed in construction are very volatile, with demand for electrical engineers rising three-fold by 2029, then dropping below current levels in the late 2030s. Electricians, mechanical trades, and operations managers, meanwhile, increase over the entire period as they are also required for operations and maintenance. The rapid increase in requirements for energy workers brings a high risk of skill shortages which could impact on the achievement of the ISP’s optimal development path. Skill shortages create the risks of delays, increased project costs, and increased cost of capital to reflect increased risk.

• Workforce projections were also developed for the 2022 ISP. The increase in workforce requirements from now until 2030 has become steeper in all three scenarios between the 2022 and 2024 workforce projections. While this is challenging, it is needed to enable Australia’s emission targets to be reached, which in turn will require a rapid scaling up of the workforce each year from now until 2030.

• The electricity workforce needed nationally to deliver the energy transformation is far larger and more diverse than outlined in this report. The workforce required for energy efficiency, demand and energy management, and electrification will be significant, with considerable overlap with the occupations already identified in shortage for electricity supply, such as electricians and engineers. There is a dearth of information on the scale of this workforce, with estimates for 2030 varying from 200,000 to 400,000. This information gap needs to be urgently addressed if we are to develop the energy workforce of the future.

Figure 2 National Electricity Market, jobs by technology group, Step Change Scenario

This research also provides recommendations to assist in resolving the ‘boom/bust’ project development – and workforce requirement – lifecycles. This includes mandating trainee workforce development as part of government-funded energy projects, and using financial signals to trigger investment decision timing that smooths energy project development profiles.

Impact of project

This report highlights major risks of skill shortages in the energy sector. There is an urgent need for governments, training providers, and industry to take coordinated action to implement workforce development strategies. Employment and training should be designed to facilitate a rapid build-out of energy resources and increase the equity of the energy transition, with training or development initiatives including opportunities for First Nations people and communities most impacted by the transition.

New government policies are being implemented or under development but need to be accelerated. There are a range of structural challenges that need to be addressed to increase the capacity of the training system to scale up the workforce.

Powering Skills Organisation, the primary Skills Council for the electricity sector, has identified a range of key issues that need to be addressed to meet demands for the future energy workforce:

- Lack of diversity in the workforce: the energy sector has low participation amongst women and First Nations people in particular, which limits its capacity to grow rapidly.

- Coordination across sectors: there is competition between sectors for the same groups of workers and a fragmentation of responsibility across Skills Councils. Infrastructure Australia has also advocated for the development of a National Infrastructure Workforce Strategy.

- A shortfall in VET trainers: there is a labour shortage for trainers that also needs to be scaled rapidly.

- Inefficiencies in energy training packages: a package of reforms are proposed to improve the speed in development of training packages and delivery of training.

- Gaps in clean energy skills and options in training packages: there are gaps in elective skills and post-trade qualifications required to build the energy workforce with the right skills.

Jobs and Skills Australia has also identified a range of reforms to increase capacity such as establishing TAFE Centres of Excellence.

Outputs

See the Australian Electricity Workforce for the 2024 Integrated System Plan: Projections to 2050 report for comprehensive notes on workforce projections and full discussion of policy background and recommendations.

See the “Focus on..” reports for New South Wales, Queensland, South Australia, Tasmania, and Victoria. These provide detailed results for each state, including employment by candidate REZ, and occupational and technology employment breakdowns for the state.

An Excel-based workbook is also available that provides annual workforce figures for the NEM and each state across each of the three ISP scenarios.

Project partners – industry and research

Status

- Completed

Project Leaders

- Jay Rutovitz, UTS

Reports

- Policy Brief

- The Australian Electricity Workforce for the 2024 Integrated System Plan: Projections to 2050.

- Electricity Workforce Projections for the 2024 Integrated System Plan: Focus on New South Wales

- Electricity Workforce Projections for the 2024 Integrated System Plan: Focus on Victoria

- Electricity Workforce Projections for the 2024 Integrated System Plan: Focus on Queensland

- Electricity Workforce Projections for the 2024 Integrated System Plan: Focus on South Australia

- Electricity Workforce Projections for the 2024 Integrated System Plan: Focus on Tasmania

- Workbook

Completion Date

September 2024

Project Code

0858